Cable video streaming service subscriptions are declining. According to eMarketer, by 2024, the number of pay-TV cord-cutters will reach 46.6 million, or more than one-third of all U.S. households.

This begs the question: Should U.S. tier 2 and tier 3 MSOs stay in the streaming business, or should they focus on broadband, dropping video altogether? Before we can possibly answer this question, it’s important to look at the industry landscape for cable streaming services in the U.S.

Create Sleek and User-Centric Viewing Experiences

With the rise of SVOD services like Netflix and Hulu, consumers have grown accustomed to streaming services and the sleek user experience they offer.

Even linear channels and nationwide services from virtual MVPDs, such as YouTube TV and Sling, provide a modern streaming experience. With these services, you get access to a mix of live TV, time-shifted TV, cloud DVR and VOD. You can consume these services on your own devices, whether you are at home or on the go.

A direct consequence of this trend is that television has become an app that can run on any device. And there is no going back! Studies show that subscriptions to services from virtual multi-video program distributors (vMVPDs) are growing. About 18% of U.S. adults ages 18-44 currently subscribe to a virtual MVPD service.

Overcome Cost Challenges

Churn and cord-cutting are reducing the number of paying video subscribers. Meanwhile, the cost of maintenance and operation for traditional video headend is not getting any cheaper; and the cost of programming for cable streaming services keeps climbing.

Continuing to use a legacy QAM delivery platform, with a set-top box and a grid EPG for the user experience is a dead-end approach for cable operators. It will only fuel the vicious cycle of increasing your costs and reducing the number of paying subscribers.

Instead, what if you combined your broadband service with a modern cable streaming video service? Could you create a new competitive bundle?

If the broadband and video bundle is competitive, customers will still be attracted to its simplicity. A relevant streaming video service for cable operators will help differentiate and protect your broadband business from high-speed data competition.

Drive New Revenue and Business Opportunities for Cable Streaming Services

When moving from a legacy cable video service to a streaming service, you take advantage of OTT technology, even if the service is delivered on-net only. One very advantageous OTT-enabled technology is dynamic ad insertion (DAI).

With DAI, your video platform has a unicast connection to each client app and can deliver targeted ads. Ads can be sold and purchased in real-time, leveraging a new programmatic ecosystem of buyers and sellers connected via a growing number of marketplaces.

By implementing DAI on your streaming service, you can capture incremental revenue via programmatic insertion into new channels (channels with no ad insertion on the legacy service). You can also boost your revenue through unsold inventory (channels with ad insertion on the legacy service).

In the U.S.A, the FCC is drastically downsizing the satellite C-band spectrum, federal funding is available to MSOs that rely on C-band satellite reception to receive their video feeds. Many MSOs have elected the lump sum option and can apply these funds to transition away from satellite to a managed cable streaming service for over-the-top video delivery.

A Hosted and Fully Managed Video Streaming Platform Is the Right Approach

Should you keep your cable video service and stay in the video business? Yes, but change the course. The time to transition away from legacy QAM services on STBs is now. With the move to a cost-effective and managed video streaming service, a video streaming offering can add to your business value. Video can help differentiate your broadband business, and streaming offers new revenue opportunities unavailable via legacy video cable services.

Recommendations for Cable Operators to Launch a Streaming Service

Maximize your chances of success when launching a modern and competitive cable video service with these recommendations.

- Keep it simple. Outsource the complexity and cost of headend management. Move to a managed and hosted solution for your streaming and legacy services.

- Plan the transition. Switch first to IP-delivered feeds. With this QAM-ready MPEG-2 or H.264 feeds you can shut down your legacy headends while securing your legacy service and revenue. From there you can deploy the streaming service at your own pace.

- Future-proof your investment. Streaming is a fluid technology and new features, devices or requirements are introduced continuously. It is critical to select a cloud-based video solution that will never become obsolete. To that effect, choosing a video platform offered as a service makes the most sense.

- Preserve old ads, leverage new ads. As your streaming subscriber base grows, it is essential to ensure that your traditional DPI ads are still inserted on the streaming side. As a video subscriber moves from legacy to streaming, you still need these eyeballs to bring in local ad revenue. This is what is referred to as parity and should be part of the minimum capabilities of a new video platform.

Once parity is in place, you can leverage the DAI capability of your video platform to monetize undersold or unsold inventory with programmatic ads.

Transition Your Cable Video Service Offering to Streaming

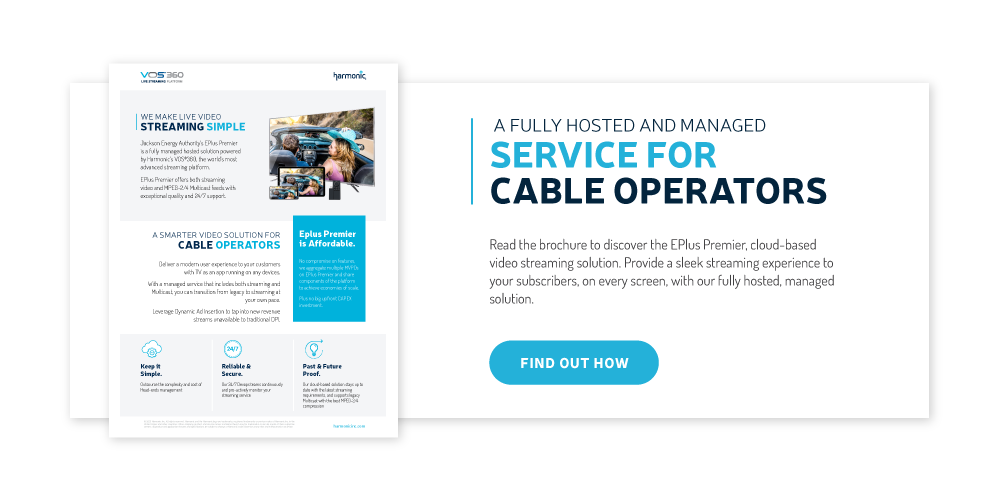

Harmonic has partnered with Jackson Energy Authority to offer E+ Premier, a fully managed hosted solution that simplifies your cable streaming service operations. E+ Premier is a turnkey streaming service that gives your subscribers the app-based, OTT-like user experience they want.

Powered by our cloud-based VOS®360 SaaS, you can benefit from the world’s most advanced streaming capabilities. E+ Premier is also a multicast service with unrivaled MPEG-2/4 efficiency to free up QAMs and increase broadband capacity. Contact us today to start a discussion with a Harmonic team member on how to ensure your video streaming services provide the greatest value.